CA Certification

The CA certification has three stages of assessment

- CA Foundation

- CA Intermediate

- CA Final

The CA Foundation course by CICA aid learners in developing an understanding of the role of Chartered Accountant in a company. This well-planned course focuses on ensuring conceptual clarity of accounting concepts, laws, general economics and compliances. The motto of the course is to build a strong foundation for learners.

What is CFA?

Professional CFA Coaching

Take advantage of mentors who have a wealth of industry experience and an in-depth knowledge of the CFA syllabus.

inclusive Study Materials

Get access to excellent tools and practice materials that are compliant with the most recent CFA Institute guidelines.

Customized Support

Get committed coaching and mentoring as you prepare for the CFA exam.

Track Record of Success

Make use of CICA’s track record of assisting students in obtaining high scores in the CFA Exam.

Online Interactive Classes

Use Interactive Online Classes to Become a CFA Expert.

100% Placement Assistance

Get your ideal job with our 100% placement assistance.

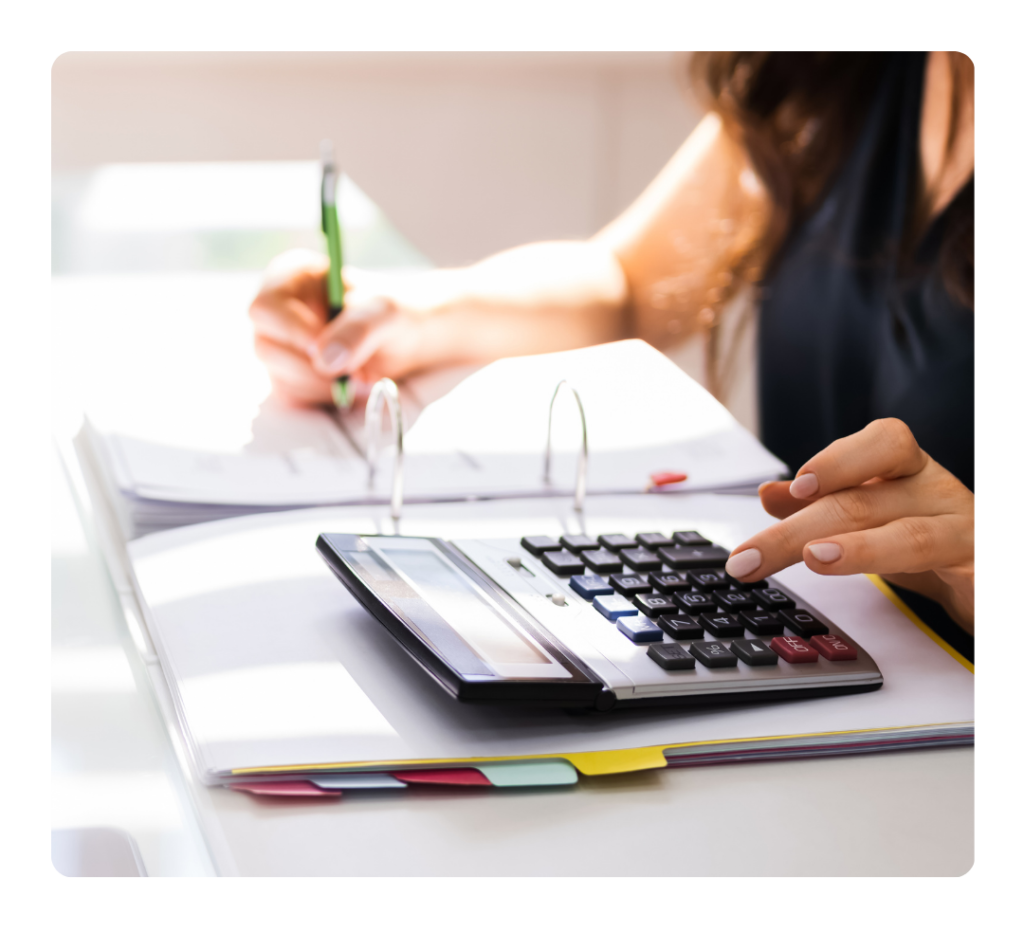

CICA: Your Trusted Partner For CA Coaching

You can succeed in all levels of the CA Exam with the help of CICA, the best CA coaching in India. We differentiate with our proven curriculum, expert educational professionals, and one-on-one counseling.

Do you want to work towards becoming a Chartered Accountant (CA), but you’re afraid of the process?

CICA is available to help you at every turn. We are a top organization known for offering outstanding CA coaching, enabling students all over India to reach their career objectives.

CA Exam Syllabus

FOR FOUNDATION LEVEL

- Principles and Practice of Accounting

- Business Laws and Business Correspondence and Reporting

- Business Mathematics, Logical Reasoning & Statistics

- Business Economics and Business and Commercial Knowledge

Alumni Works Here, You Could Too

FOR INTERMEDIATE LEVEL

- Paper – 1: Accounting

- Paper – 2: Business Laws, Ethics and Communication

- Paper – 3: Cost and Management Accounting

- Paper – 4: Taxation: Sec-A: Income-tax Law: Sec-B: Indirect Taxes

- Paper – 5: Advanced Accounting

- Paper – 6: Auditing and Assurance

FOR FINAL LEVEL

- Group 1

- Paper-1: Financial Reporting

- Paper-2: Strategic Financial Management

- PaPaper-3: Advanced Auditing and Professional Ethics

- Paper-4: Corporate and Economic Laws

FOR FINAL LEVEL

- Group 2

- Paper-5: Strategic Cost Management and Performance Evaluation

- Paper-6A: Risk Management

- Paper-6B: Financial Services and Capital Markets

- Paper-6C: International Taxation

- Paper-6D: Economics Laws

- Paper-6E: Global Financial Reposting Standards

- Paper-6F: Multidisciplinary Case Study

- Paper-7: Direct Tax Laws and International Taxation

- Paper-8: Indirect Tax Law